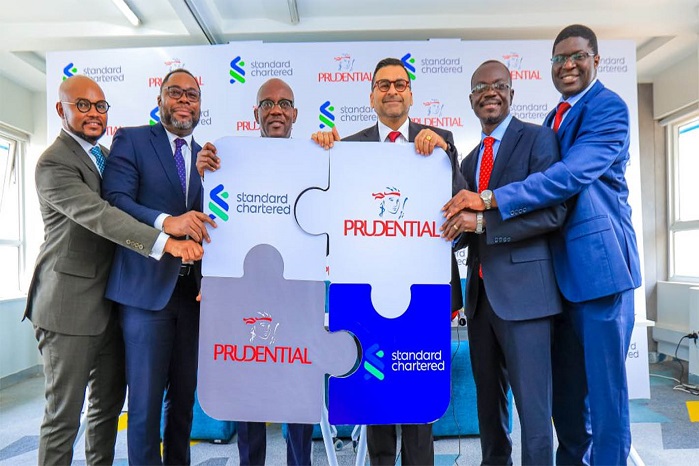

HABARI DAILY I Kampala, Uganda I In a move likely to transform insurance uptake, Standard Chartered Bank Uganda has joined hands with Prudential Uganda, to strengthen bancassurance in the country.

Bancassurance is the practice of selling life assurance and other insurance products and services by banking institutions.

The two firms penned an agreement in Kampala recently in a move that will enable Standard Chartered’s clients to access Prudential Uganda’s comprehensive insurance solutions.

The move is expected to foster financial inclusion and security in Uganda.

Sanjay Rughani, Standard Chartered Bank’s CEO said the strategic move is set to revolutionize the country’s financial services landscape.

He pointed out that by combining their banking expertise with Prudential’s insurance prowess, we’re empowering our clients by making their investments stronger.

Sanjay Rughani, Standard Chartered Bank’s CEO

“As a result, they will be able to manage risk and achieve their financial goals,” he said, adding that the partnership underscores their commitment to delivering innovative financial solutions to Ugandans.

Tetteh Ayitevie, the Prudential Uganda CEO said the move will broaden access to insurance products, adding that their shared vision is to create a more financially inclusive environment, enabling individuals and businesses to thrive.

He added that the union will leverage the strengths of both organizations, providing enhanced financial protection for individuals and businesses. “Increased access to life insurance is good for Uganda’s economy. It will result in a rise in health coverage, retirement solutions, and will provide convenient one-stop banking and insurance services,” he said.

Uganda’s bancassurance sector has grown tremendously, leading to not only a rise in insurance uptake but also financial inclusion.

This has additionally led to deepening in the access to financial services and providing long-term financial security solutions to customers.

Financial institutions are casting their net further into the insurance business through bancassurance, where growth in premiums has now reached sh170b in 2023.