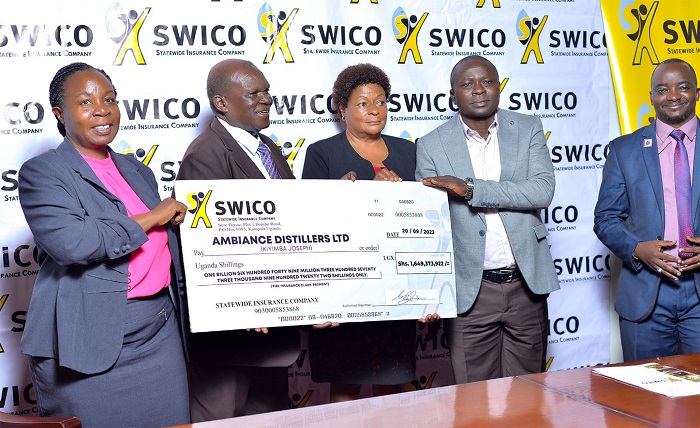

Florence Namagembe, General Manager,Joseph William Kiwanuka, Executive Director, Statewide Insurance Company, Ms. Evelyn N. Muwemba, Chief Executive Officer, Joseph Kiyimba the proprietor of Ambiance Distillers receiving a cheque and Ronald Jaggwe Muyingo, Marketing & Sales Manager

Kampala, Uganda I HABARI DAILY I Statewide Insurance Company has paid sh1.6 billion insurance claim to Ambiance distillers Ltd following fire damages suffered by the company four months ago. Ronald Jaggwe, the marketing and sales manager at SWICO, revealed during a media briefing at their head offices in Kampala that the insurance claim remains one of the highest in the industry this year.

“This year, over sh400 billion have been paid out across the sector of 21 players. Our compensation of sh1.6 billion insurance claim to Ambiance distillers Ltd is so far the highest in the industry this year,” he said. “The payment was made following fire damages suffered by Ambiance Distillers Ltd. Joseph Kiwanuka, the proprietor of the company who has also been into insurance for over 40 years,” he added.

Commenting on the claim he received from SWICO, Kiwanuka said insurance is one way of safeguarding a business against any form of risk. He said that there is a mindset among people that insurance is for the rich class which is not true. “It doesn’t matter whether you have a small and medium sized business. This insurance can help you at a very difficult time when your business is having a challenge,” he remarked. “If I had not insured my business, I would now be finished. But with the sh1.6bn I can restore my business,” Kiwanuka said smilingly.

Claims drop in the second quarter of 2023 Gross insurance claims paid on account of both life and non-life (including HMOs) dropped 6.1 percent from 37.6% of the total premiums registered in the second quarter of 2023 compared to 43.7% of total premiums registered in the second quarter of 2022.

According to Alhaj Kaddunabbi Ibrahim Lubega, Chief Executive officer of Insurance Regulatory Authority of Uganda, the 37.6% of the total premiums registered in the second quarter of 2023 are equivalent to sh311.3billion. He said that as the industry’s regulator, they shall continue to examine the trends as the year progresses and ensure that all payable claims are paid, and in good time.

Fire accidents increase

The 2022 Police report indicates that fire incidents increased by 16% in 2022 compared to 2021. The report revealed that 976 of 1258 of fire cases reported in 2022 were in the Kampala Metropolitan area.

This leaves many succumbing to not only injuries but also others losing out their businesses as a result of failure to reinstate their businesses.

Industry performance

The insurance sector continued to grow favourably increasing from sh711.6billion in the second quarter of 2022 to sh828.9bn in the second quarter of 2023, representing a 16.5 percent increase during the reporting period. This 16.5% growth, according to Kaddunabbi, is a reflection of the sector’s attraction of more customers committing more money to purchase insurance. “This steady growth is worthy of acknowledgement because it is a reflection of, among other things, the sector’s attraction of more customers and businesses committing more money to purchase insurance,” he noted.

As at the end of June 2023, Non-life business generated sh510.1billion growing from sh309.8billion in Q1 2023 (representing about 56.8% of the total premiums from the same

segment in the full year, 2022 which amounted to sh898.10 billion.