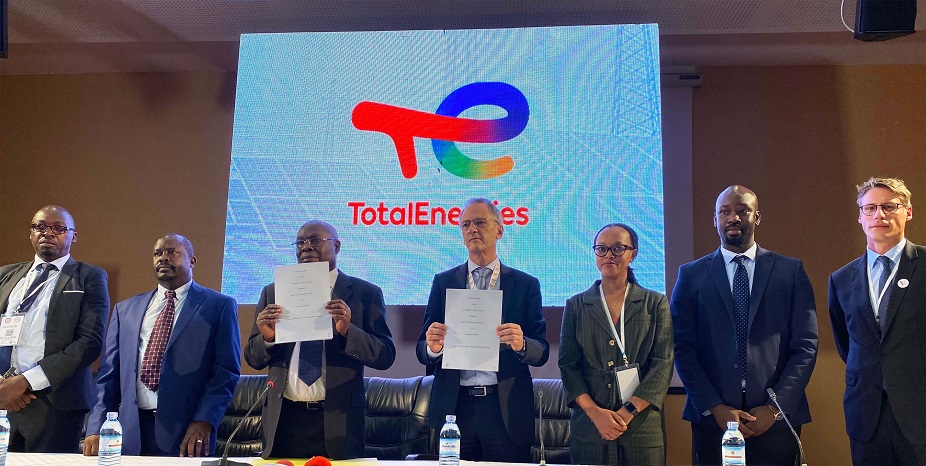

Officials of TotalEnergies EP displays a recently signed Solar project agreement with the Government of for the deployment of 120 MW of Solar Photovoltaic PV technology

HABARI DAILY I Kampala, Uganda I TotalEnergies, the biggest investor in Uganda’s oil and gas industry, has expanded its investment portfolio in the East African country’s energy sector through a major acquisition.

According to a recently issued press statement, TotalEnergies has signed an agreement with Scatec, a Norwegian renewable energy company, to acquire 100% of its subsidiary SN Power, which holds interests in renewable hydropower projects in Africa, through a joint venture (51% SN Power) with Norfund and British International Investment (BII).

“This transaction practically means that we have acquired a 28.3% stake in the Bujagali hydropower plant currently in operation in Uganda,” reads part of the press statement.

The Bujagali plant boasts of a capacity of 250 MW and covers more than 25% of the country’s peak electricity demand.

Headquartered in France, TotalEnergies is currently running the Tilenga project, which includes the development of six fields and the drilling of around 400 wells from 31 locations in Hoima, western Uganda.

The transaction also means that TotalEnergies will also acquire minority stakes in two projects under development in Rwanda (260 MW) and Malawi (360 MW).

This reflects the company’s desire to contribute to the continent’s energy transition by bringing electricity to the people of African countries

“This acquisition of renewable hydroelectric assets and projects in Africa, makes us a major player in hydro power in Uganda, a country where we are also developing a major oil project.”” reads part of the press release, signed by Patrick Pouyanné, the TotalEnergies Chairman and CEO.

Dated July 30, 2024, the release further says that the acquisition is another example of their ability to implement a multi-energy strategy in oil-producing countries to support them in their energy transition.

Pouyanné further says the transaction makes TotalEnergies a strong asset owner going forward, with the ability to further develop the projects and contribute to the energy transition in Africa.

“We are grateful to the entire hydropower team for their hard work and dedication over the years. Additionally, we are grateful to our joint venture partners, host governments, and lenders for the support since 2020,” said Terje Pilskog, CEO of Scatec.

Pouyanné said that to date, TotalEnergies has interests in a number of hydropower projects with a gross capacity of 3.7 GW worldwide.

The company boast of 218 MW installed power stock in France (19 MW), Portugal (33 MW) and Turkey (166 MW), in addition to 1.5 GW under development in Mozambique (Mphanda Nkuwa project) as well as 2 GW under development by Adani Green in India,” he said.

Said Pouyanné: “As part of our ambition to get to net zero by 2050, we are building a world class cost-competitive portfolio combining renewables (solar, onshore and offshore wind) and flexible assets (CCGT, storage) to deliver clean firm power to its customers.”

He said at the end of 2023, TotalEnergies’ gross renewable electricity generation installed capacity was 22 GW.

“We will continue to expand this business to reach 35 GW in 2025 and more than 100 TWh of net electricity production by 2030,” said TotalEnergies’ boss.

TotalEnergies is a global integrated energy company that produces and markets energies which include oil and biofuels, natural gas and green gases, renewables as well as electricity.

Its employees, who number to more than 100,000, are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable.

The firm is active in about 120 countries, and we place sustainability at the heart of our strategy, projects and operations