HABARI DAILY I Kampala, Uganda I The Bank of Uganda has expressed optimism about the country’s growth prospects, attributing this to a consistent decline in inflation.

It added its voice to that of the World Bank, which recently projected a positive picture over the medium-term, saying Uganda’s GDP will grow by 6.2% in FY24/25, and will later accelerate to more than 7% in the medium term due primarily to investment in the oil and gas sector.

Michael Atingi-Ego, BOU’s Deputy Governor recently said they were forced to lower the interest rate from 10.0% in September 2024 to stimulate economic growth.

“This decision reflects the country’s improved inflation outlook, driven by subdued inflation levels, and better economic outlook,” he said.

He added that over the twelve months to September 2024, annual headline and core inflation both averaged 3.2%.

“Specifically, annual headline and core inflation decreased to 3.0% and 3.7% in September 2024, down from 3.5% and 3.9% in August 2024, respectively. Notably, inflation declined in September 2024, driven by lower oil prices and reduced food prices,” he said in a recent statement, adding that the decline in core inflation was primarily attributed to a reduction in services inflation, particularly in passenger transport services.

“This was mainly because of improved export earnings from coffee and gold exports, ease in effects of the global economic shocks like #Covid-19 and the war in Ukraine, the monetary policy tightening, and relative stability of the shilling against the dollar,” he said.

The deputy governor added that considering these developments, they expect the inflation rate to remain below the target range of 5 percent and can therefore comfortably ease the Monetary Policy to enable support to private sector credit growth.

Borrowing by the private sector has been a bit suppressed, only growing by 6.8 percent over the last financial year, compared to 5.0 percent. However, BoU says that while there is this growth in the increase, it is half of the targeted growth of 13%.

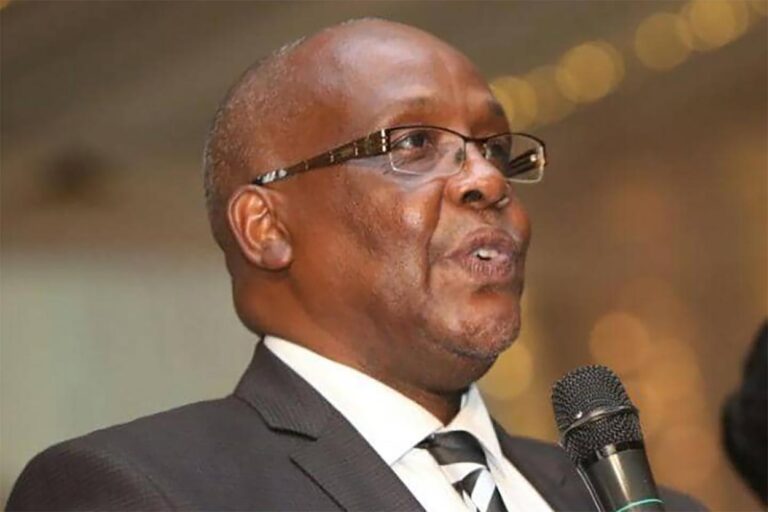

Michael Atingi-Ego, BOU’s Deputy Governor

The Deputy Governor said that their activities as well as other changes that make the economy safer going forward, have decided to reduce the rate, though cautiously.

“Looking ahead, we project core inflation to remain below the 5% target over the next 12 months. This forecast is supported by a relatively stable shilling exchange rate and favorable food and oil prices,” he noted

He however pointed out that inflation is expected to return to the target level in the medium term.

“Our monetary Policy Committee (MPC) has noted that Uganda’s economy is growing strong, with a 6.6% annual quarterly real GDP growth rate as of June 2024,” he said.

He added that economic growth is projected at 6.0-6.5% in FY 2024/25 and 7.0% in subsequent years, driven by strategic government interventions, increased foreign direct investment in the extractive industry, and the commencement of oil production in FY2025/26.

“The MPC notes that easing of monetary policy is necessary to keep inflation on track while supporting socioeconomic transformation. Any additional changes to the policy rate will continue to rely upon the incoming data and the evolving assessment of risks to guide its decisions,” he said.

The bands on the CBR remain at +/-2 percentage points, and the margins on the CBR for the rediscount and bank rates at 3 and 4 percentage points, respectively.

As a result, the rediscount and bank rates have been reduced to 12.75% and 13.75%, respectively.