Sarah Komugisha (R), the Ecobank Brand and Communications Manager pause with other bank officials following the partnership signing at Golden Turip Hotel recently

HABARI DAILY I Kampala, Uganda I Ecobank Uganda has entered into a partnership with SurePay, a digital and payments solution company to revolutionalise school fees payments, and ease planning for school proprietors.

The facility, which will benefit both Ecobank customers and non-customers, introduces a free, streamlined, secure, and user-friendly platform for schools, students, and parents across the region to collect and manage school fees easily.

Speaking during the unveiling of the new product, Grace Muliisa, Ecobank Uganda’s Managing Director said this collaboration reflects the bank’s commitment to digital transformation and to supporting educational institutions through innovative payment solutions.

“The process begins when an Ecobank branch identifies a school to join the SurePay platform. Schools open an account with Ecobank and are then on-boarded onto the SurePay platform, ensuring seamless and efficient transactions,” she said.

The launch event, which was held at a colorful function at Golden Turip Hotel at Nakasero, Kampala, brought together over one hundred school proprietors, bankers and teachers.

The participants were taken through the benefits of using surepay, the most important of which is that payments can be made through various channels, offering unparalleled convenience for both Ecobank customers and non-customers.

“Payment options include the Ecobank Mobile App, Quick Teller-Interswitch, over-the-counter services and ABC Agents spread across the country,” said Muliisa.

On what makes SurePay a Game-Changer, Ibrahim Nuyombya the firm’s Marketing Manager said the system offers real-time processing, whereby payments are transferred directly to the school’s Ecobank account instantly.

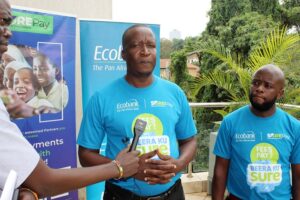

Moses Okiror (C), the managing director, SurePay in a media interview following the partnership signing

“Since each transaction is followed by an instant SMS notification, this system eliminates the complexities of manual tracking. Once a payment is made, both a parent and a school receive an instant notification showing details of the payment made,” he said.

He further noted that the system also generates unique student codes whereby each student is assigned a unique code, enabling schools to track payments effortlessly.

“The system also boasts of versatile payment options, whereby parents enjoy the flexibility of multiple payment methods tailored to their convenience.

Nuyombya also added that one a client embraces the system, it provides them with immediate fund accessibility, whereby payments which are made via SurePay are settled directly into the school’s Ecobank account, ensuring immediate access to funds for school operations.

“There is also auto generation of learners’ report cards whereby the Surepay system freely enables schools to automatically generate learners’ report cards,” he said, adding that beneficiaries easily access Nursery, Primary, O and A level reports covering the new curriculum. It also does advanced academic management tasks.

The system also has an inbuilt SMS platform which enables schools to do their communications about school fees reminders, meeting invitations or any other marketing messages easily and effectively.

“Each individual beneficiary can feely get all financial reports which include income statements, cash flows or balance sheet on the surepay system,” he said.

Sarah Komugisha, the Ecobank Brand and Communications Manager said the system can even serve wail in clients.

“Whether someone is an Ecobank account holder or not, we always strive to deliver seamless banking experience for all,” she said.

She further said that by offering schools a secure and simplified payment platform, they are not only making it easier for parents to pay school fees but also enhancing schools’ financial management by ensuring real-time fund transfers.

Continental reach

Ecobank Uganda is a subsidiary of Ecobank Transnational Incorporated, the leading Pan African Bank operating in over 35 African countries. It’s parent company is headquartered in Lomé, Togo.

On the other hand, Ecobank Group operates in 33 countries in Africa in addition to having local representative offices in Addis Abeba, Ethiopia and Johannesburg, South Africa.

The Group also has a banking license in France and international offices in Beijing, China; London, UK; and Dubai, the United Arab Emirates. Ecobank began its operations in Uganda in 2019 and has 10 branches located in Kampala, Entebbe, Mbarara and Jinja and two service centers in Kireka and Nakasero.

As part of its digital strategy, the bank has 14 ATMs across the country with over 170 personnel and over 14 Xpress Point (agency banking points) serving customers through its Consumer, Commercial and banking, SME and treasury business divisions.

Innovative firm

SurePay, on the other hand, is a digital and payments solution company licensed by Bank of Uganda, whose mission is to support SMEs with digital and payments solutions, in a move to revolutionalise the sector.

The firm, which operates in East and Southern Africa, is headquartered in Ntinda, Kampala. It’s payment solutions are tailored for several beneficiaries, who include schools (school information management system), merchant service (pay ins and pay outs), churches (Church Management System), Estate managers (Property Management System) and then SACCOs & Microfinance institutions (Sure Banker).