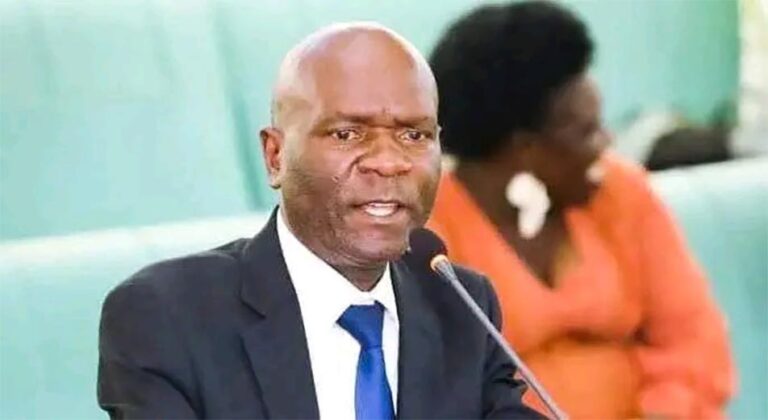

Claver Serumaga, the Executive Director at Equity Bank Uganda welcoming Pastor Robert Kayanja at the Tupange Business with Equity 2025 Forum at Hotel Africana

HABARI DAILY I Kampala, Uganda I The Tupange Business 2025 with Equity Nationwide Forum has officially been unveiled at a colourful ceremony which attracted hundreds of entrepreneurs, policy makers and leaders.

Aimed at helping Small and Medium Enterprises (SMEs) customer grow stronger through more connected business opportunities within key value chains, the event run on the theme: “Financing Integrated Value Chains and SME Growth.”

The launch took place at Hotel Africana in Kampala, with more sessions planned in Mbale on Tuesday 19th August and in Arua on Thursday 21st August 2025 with Fort Portal and Hoima closing the series with events on Tuesday 2nd and Thursday 9th September 2025 respectively.

Olivia Mugaba, Head of SME at Equity Bank Uganda pointed out that SMEs run the world, since they are the heartbeat of our economy, creating seven out of every ten jobs globally.

“At Equity Bank Uganda, we recognise their power and potential, which is why our focus is on financing integrated value chains, helping entrepreneurs manage cash flow, optimise operations, and unlock growth from the top anchor to the last mile,” she said, adding that when they empower SMEs, they empower the nation.

Her words resonated as the event showcased how Tupange Business with Equity connects farmers, traders, and distributors, ensuring every step of the value chain thrives.

Claver Serumaga, Equity Bank Uganda’s Executive Director highlighted the importance of these events being critical to the bank’s mission to bring financial solutions and business support closer to SMEs across the country

“We are committed to creating seamless banking experiences that empower SMEs to operate more efficiently. Through innovations such as real-time payments, bulk salary processing, and unsecured supplier financing of up to Shs 1.5 billion, we continue to invest in solutions that enable sustainable business growth.”

MD Serumaga emphasising a point during the forum

Said Serumaga: “We view every SME as part of a broader value chain that drives economic growth. By supporting your entire ecosystem and remaining fully accountable to our clients. We ensure that as your business expands, Equity Bank grows alongside you.”

As part of the launch event, there were interactive sessions where entrepreneurs and SMEs learned how integrated financing strengthens their supply chains, from raw material suppliers to end consumers.

Serumaga later introduced a revamped, cutting-edge banking technology solution, stating: “At Equity Bank, we bring banking closer to SMEs- from agents and POS services to our soon-to-launch Pay with Equity platform, making daily cash flow and transactions seamless for business growth.”

The technological advancement has been specially updated to empower even the smallest businesses to manage finances and transactions with ease.

The launch also featured inspiring testimonies from key customers, who included Pastor Robert Kayanja, the Founder and Senior Pastor of the Miracle Centre Cathedral.

Pastor Kayanja addressing the delegates

He shared a personal story which revolved around the message that Equity Bank is more than a financial institution.

“It’s a partner that cares for people. In Karamoja, they stood with us in our fight against hunger, financing tractors and agricultural projects that have transformed communities,” he said, adding that their support proves that with the right partner, SMEs and social enterprises can thrive.

“Together we can create sustainable solutions that change lives.” His testimony underscored Equity Bank’s impact on social good, resonating with the audience’s aspirations for community upliftment.”

Dr. Fred Muhumuza, the Senior Lecturer at the Makerere University Business School (MUBS) and Director of the MUBS Economic Forum, who stood in as the key note speaker, offered the economic perspective to the conversation.

He pointed out that in business, one’s success is tied to every link in your value chain.

“If the person who supplies you or buys from you struggles financially, you will feel it too. That’s why Equity Bank works to finance the entire chain, so every link is strong. From the farmer in the village to the trader in the market, everyone is part of a value chain,” he said.

Equity Bank awards one of the best SME clients Nuhu Kanyike, Managing Director- Falkan Investments Limited at the Tupange Business with Equity 2025 launch

Dr Muhumuza, who holds a Ph.D. (Development Economics) from the University of Manchester, among other qualifications, further provided insights that reinforced the Tupange Business with Equity program’s focus on holistic economic empowerment.

In 2024, the Tupange Business Ne Equity engagement reached over 600 SME proprietors across the country, offering them advisory services, financial knowledge, and networking opportunities.

This year’s target is to support over 1,000 SMEs by year-end, as Equity Bank Uganda continues to position itself as a catalyst for national development, proving that when SMEs thrive, the nation prospers. The meetings also aim to scale up customer engagements with the retail SME segment at the regional level.

As the roadshow kicks off and as the bank invites entrepreneurs and SMEs to join this journey of growth and transformation, Equity Bank’s continued investment in SMEs is about building strong value chains, promoting economic inclusion, and supporting national development.

By financing and connecting every part of the business ecosystem, the Bank is helping Ugandan SMEs thrive now and in the future.