Women show off their handcrafts to an official

HABARI DAILY I Kampala, Uganda I As of mid-2025, the World Bank-funded Generating Growth Opportunities and Productivity of Women Enterprises (GROW) project in Uganda has reached over 2,950 women-owned enterprises with low-interest loans. These loans boast of 10% interest rate per year.

The initiative, aimed at supporting female entrepreneurs, has primarily focused on micro and small enterprises, with 75% of loans going to borrowers in the Shs 2 million to Shs 20 million range.

The Ministry of Gender Labor and Social Development (MGLSD) and the Private Sector Foundation Uganda (PSFU) with support from the World Bank (WB) are implementing the GROW project.

Dr Ruth Aisha Biyinzika Kasolo, the GROW Project Coordinator at the Private Foundation Uganda (PSFU), says that the project aims to reach 28,750 women by 2027.

“These loans, which are often used for business expansion and capital, have enabled women in sectors like agriculture and commerce to scale their businesses. The impact has been great, especially among the low income earning women around the country,” she said.

In order to qualify, businesses must be at least 51% owned by women and the loans are designed for growing, not starting, a business.

This is in fulfillment of the conditions that were required by the funders. The GROW Project is expected to close on 31st December 2027.

The project development objective is to increase access to entrepreneurial services that enable female entrepreneurs to grow their enterprises in targeted locations, including in host and refugee districts.

“Part of the GROW project resources totaling $70m (sh260b) is designated to support the GROW Financing Facility (GFF), a combination of the GROW Loan and a GROW Bonus grant to women entrepreneurs who are seeking to grow and expand their businesses from micro to small level and from small to medium level under 2 (two) sub-components of the project,” reads the project brief.

The proceeds of the GFF, targeting 28,750 beneficiaries, have been disbursed through Participating Financial Institutions (PFIs) that currently include Commercial Banks and which will eventually extend to Micro-Finance Institutions and SACCOs.

Concerning the targeted beneficiaries, the brief underscores the fact that the GROW Project is targeting women who are making a transition from existing government programs, notably the Parish Development Model (PDM) and EMYOOGA, that are ready to seek and manage loans for their businesses.

“The GROW loans and associated grants are intended to address key constraints of access to capital and enable women entrepreneurs across the country to access affordable finance to expand their businesses,” further reads the brief, adding that the priority sectors include Agriculture, Manufacturing, Tourism, Construction and Services.

Dr Biyinzika notes that since its launch, there has been a comprehensive consultative process for designing the GROW Loan product and related interventions.

“The Project under the guidance of PSFU and with the support of a World Bank consultant developed a manual that guides the implementation modalities for eligibility and criteria for accessing the loans and grants,” she said.

She added that there have also been extensive consultations with various stakeholders including the Financial Institutions (FIs), Ministry of Finance Planning and Economic Development (MFPED), other line ministries that are part of the Project Steering Committee, Bank of Uganda and Uganda Microfinance Regulatory Authority (UMRA), among other stakeholders.

Selection of Participating Financial Institutions

At the project start, PSFU issued a request for Expressions of Interest (EOIs) for FIs to implement the GFF Performance grant and the Line of Credit. PSFU received 19 Expressions of Interest that were reviewed and nine (9) of them prequalified and invited to submit proposals.

The proposals were comprehensively reviewed with the support of 2 (two) highly regarded independent consultants who thereafter undertook due diligence assessments and an extensive Environment and Social Management System (E&SMS) compliance check for each of the prequalified institutions over the period from December 2023 through to April 2024.

A subsequent report on the evaluation and due diligence assessment exercise was presented to the GFF Awards Committee for consideration and approval on 8th May 2024 followed by clearance by the World Bank “No Objection” on 31st May 2024 as part of the component disbursement conditions.

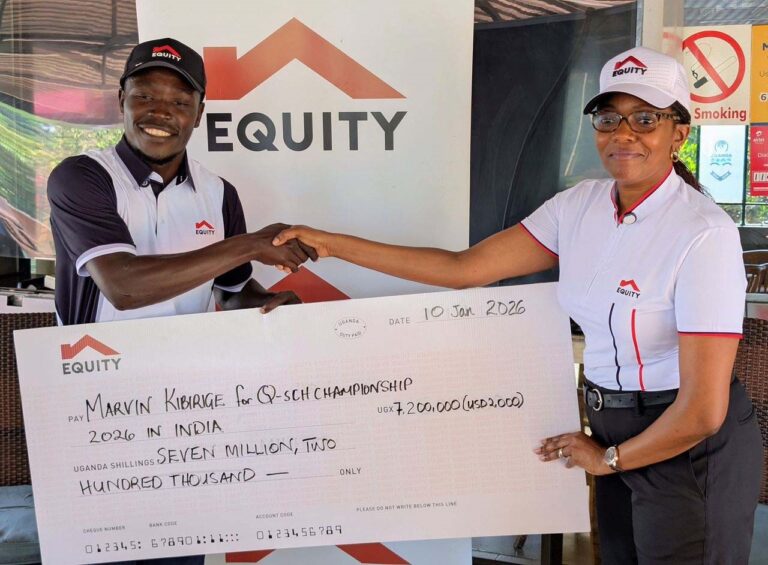

Six PFIs were selected namely Post Bank, Centenary Bank, Finance Trust Bank, Equity Bank and DFCU Bank to lend money to women entrepreneurs at affordable interest rates.

In line with the design of the GROW Loan, the participating financial institutions assume all the credit risk on the GROW loans they make and they are responsible for conducting appraisals of the women entrepreneurs and their businesses to determine their viability for funding.

The financial institutions signed participating agreements with PSFU as the entity representing the GROW Project and the Government of Uganda released funds at the start of the FY2024/2025.

The targeted number of the women entrepreneurs across the three levels is 3127 (Level 1 – 1,757; Level 2 – 1059 and Level 3 – 311). This target includes both the women entrepreneurs that are refugees and women entrepreneurs in the 13 (thirteen) designated Refugee-hosting Districts (RHDs).