View of women of Makinye Ssabagabo dancing during GROW skilling for women entrepreneurs launch at Front Page Hotel Namasuba on April 29, 2025.photo by Mary Kansiime

GROW loan beneficiaries in a jubilant mood

HABARI DAILY I Kampala, Uganda I About 703 borrowers of the Generating Growth Opportunities and Productivity for Women Enterprises (GROW) Loan are eligible for the beneficiary performance grant/bonus after completing repayments, on time, New Vision has learnt.

GROW loan borrowers are eligible for a bonus if they make their loan payments on time. The bonus can be a grant of up to 5% of the loan principal, with up to 10% applicable for specific vulnerable groups like persons with disabilities or those in selected vulnerable groups such as the Batwa, Ik, Tepeth, and Benet communities.

GROW Project is a Government of Uganda initiative supported by the World Bank with a grant of USD 217 Million. It’s is administered by the ministry of Gender, Labor and Social Development, in partnership with the PSFU.

According to the recently issued End of Year 1 (July 2024 – June 2025) Report, by 30th June 2025, 703 Loan beneficiaries, representing 23.77% of the total number of borrowers qualify for the bonus.

“The total amount earned out of the loan facility was Shs 554,230,000 ($153,953),” reads part of the report, adding that Centenary Bank led with 332 beneficiaries qualifying for the bonus, amounting to sh146,970,000.

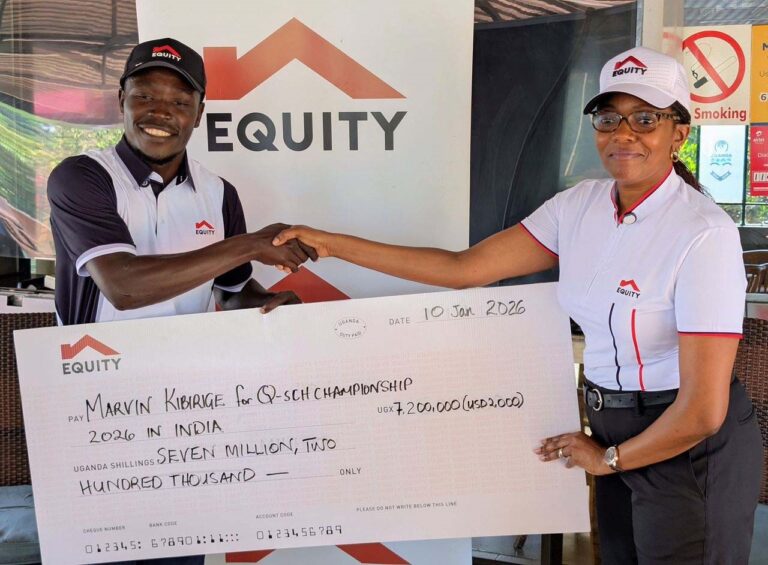

“These are followed by Finance Trust Bank with 306 beneficiaries whose bonus value amounts to sh193,420,000, Post Bank with 41beneficiaries who are set to bag sh27,660,000. These are followed by Equity Bank with 55 beneficiaries whose bonus value amounts to sh27,400,000.

DFCU Bank, on the other hand has 10 beneficiaries, with their value of bonus amounting to Shs 13,630,000.

The report, issued by Dr Ruth Aisha Kasolo Biyinzika, the GROW Project Coordinator at the Private Sector Foundation Uganda (PSFU), says that

in quarter three, 202 (including 77 male and 125 female) participating financial institution’s (PFIs) Branch staff were trained.

“Those trained in quarter three were reported to have better understanding of the GROW processes, especially the screening for E&S and documenting the purpose of the loan,” further says the report.

On the side of both existing and potential women borrowers, a total of 9,824 women were trained as part of pre-financing or post-financing training undertaken by the PFIs.

The report further says that all the 6 (six) PFIs reported several portfolio expansion activities conducted to educate women entrepreneurs about the GROW loan, its benefits, and how to access it.

“They provided information, encouraged and guided women to open new accounts and reactivating previously closed accounts, including refugee women, women in refugee hosting communities and special interest groups,” reads part of the report.

It adds that during this quarter, over 55,000 new accounts were opened among the six PFIs.

“There is also increased PFIs collaboration with district local governments, municipalities focal people particularly the Labour Officers for raising community awareness about the GROW project and financial literacy,” further says the report.

Banks reported increased customers, opening of bank accounts and male support to the women borrowers by providing collaterals and as guarantors for the loans.