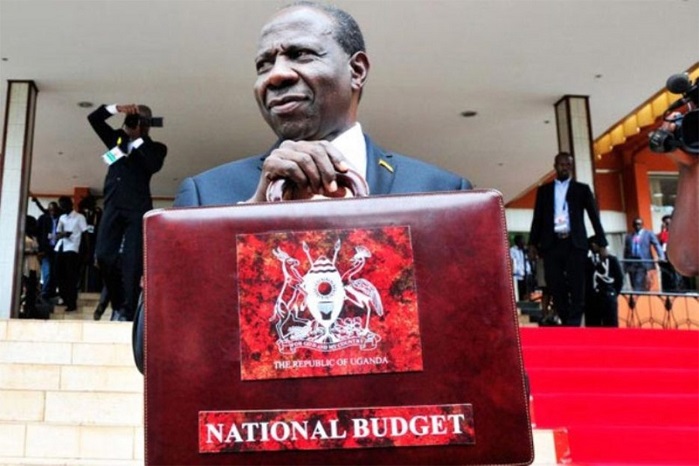

Matia Kasaija, the finance minister tomorrow will ferry the most recognizable brief case in the country containing the annual national budget

HABARI DAILY I Kampala, Uganda I Tomorrow is budget day, one of the major days that herald in the new financial year which starts on July 1st.

Ugandans are both expectant of the new economic growth instruments like to National Development Plan IV (NDP IV), the ten-fold growth strategy, as well as the new tax measures being fronted by the ministry of Finance, Planning and Economic Development.

In the new Shs 72.4 trillion budget for FY 2025/2026, the Ugandan government has prioritized several key areas in the, focusing on economic growth, human capital development, and infrastructure.

Specific sectors like manufacturing, tourism, natural resources, digital transformation, and innovation are receiving significant allocations.

For the manufacturing sector, a significant allocation of Shs 311.8 billion aims to boost manufacturing capacity and competitiveness.

When it comes to tourism, Shs 427.6 billion has been earmarked for tourism development, recognizing its potential as a growth engine.

For natural resources Shs364.9 billion has been allocated for the sustainable management of natural resources, including environment, climate change, land, and water.

When it comes the extractives industry, Shs 875.8 billion has been dedicated to the sector, reflecting its importance in the economy.

Government is also looking at Digital Transformation, to which it has allocated Shs 381.1 billion, to accelerate digital transformation across various sectors.

On the front of Innovation and Technology Transfer, the Government has put aside Shs 388.2 billion to support innovation and technology transfer, fostering technological advancements.

For public sector transformation, Government is allocating Shs 258.6 billion, focusing on efficiency and effectiveness.

Shs 599 billion has been allocated for the administration of justice, ensuring a fair and efficient legal system.

The education sector also remains a priority to Government, with calls for increased funding from civil society organizations.

Similar to education, health is a critical area, with calls for increased funding and improved staffing at local governments to ensure access to quality healthcare.

Domestic taxes

Out of the total budget, Shs37.2 trillion is expected to be raised from domestic sources through taxes and fees. An additional Shs11.3 trillion will be borrowed locally, while Shs11.32 trillion will come from external sources in the form of loans and grants linked to development projects.

To say the least, Shs10.02 trillion is allocated for refinancing existing debt, meaning new loans will be used to settle old ones. In addition, Shs11.33 trillion is earmarked solely for interest payments, a clear indicator of the heavy burden posed by public debt.

The government has also dedicated Shs29.5 trillion, nearly 41% of the entire budget, to implementing its Development Plan, focusing on infrastructure, industrialization, and service delivery. Another Shs11.4 trillion is directed toward human capital development, which includes health and education.

Security a priority

The security sector remains a key focus, receiving Shs9.9 trillion, which is more thanthe allocations for agriculture, transport, and health. Major infrastructure investments continue, with Shs2.2 trillion going to road construction and Shs2.175 trillion allocated to the long-awaited Standard Gauge Railway project.

Despite the government’s ongoing efforts to expand its tax base, structural constraints persist. According to the Bank of Uganda, the country’s tax-to-GDP ratio remains at approximately 14%, well below the East African regional average of 18–20%.

This shortfall limits the government’s ability to finance ambitious development goals without turning to further borrowing. The 2025/26 budget aligns with the goals of the National Development Plan IV (NDP IV), with a focus on increasing household incomes and enhancing economic participation, particularly through agriculture and other productive sectors.

Key initiatives receiving funding include the Parish Development Model (Shs1.03 trillion) and Emyooga (Shs100 billion), while Shs3 billion has been set aside for the Jua kali sector and Shs414 billion is allocated to the Uganda Development Bank to support local enterprises. As Uganda moves closer to the 2026 general elections, the government is stepping up implementation of these programs to transition households from subsistence farming into the money economy.

Re-election agenda

President Yoweri Museveni has taken a keen interest in these initiatives and is expected to showcase their progress during his re-election campaign.

The budget also carries Shs13 trillion in domestic debt arrears, which are placing additional pressure on the economy. Sector allocations include Shs13.8 trillion for infrastructure and transport, Shs5.9 trillion for education, Shs5.7 trillion for health, Shs6.5 trillion for security and governance, Shs1.7 trillion for agriculture, and Shs2.1 trillion for public administration and social services.

Debt trajectory

The Shs300 billion increase over the previous year’s budget, although modest, reflects the impact of inflation, costlier imports, scaled up development projects like the Standard Gauge Railway and oil pipeline, rising public sector wages, and higher debt service obligations.

As of June 2024, Uganda’s public debt stood at Shs94.9 trillion (USD 26 billion), up from Shs80.4 trillion in June 2023. This brings the debt-to-GDP ratio to 52.1%, breaching the East African Community’s 50% ceiling.

Economists and civil society organizations have expressed concern about the long term sustainability of this debt trajectory.

The 2025/26 budget sets aside Shs18.2 trillion for debt servicing—about 25% of domestic revenue. They thereby limit resources available for new development and essential public services.

Uganda has kept inflation in check over recent years, thanks to the Bank of Uganda’s cautious and proactive monetary policy. Through FY2023/24 and into FY2024/25, the central bank maintained a tight policy stance with timely adjustments to the Central Bank Rate.

The broader economic picture remains positive. Uganda posted a real GDP growth rate of 6.1% in FY2023/24, up from 5.3% in the previous year.

The Ministry of Finance forecasts growth of 6.2% in FY2024/25 and 7.0% in FY2025/26, supported by ongoing infrastructure.