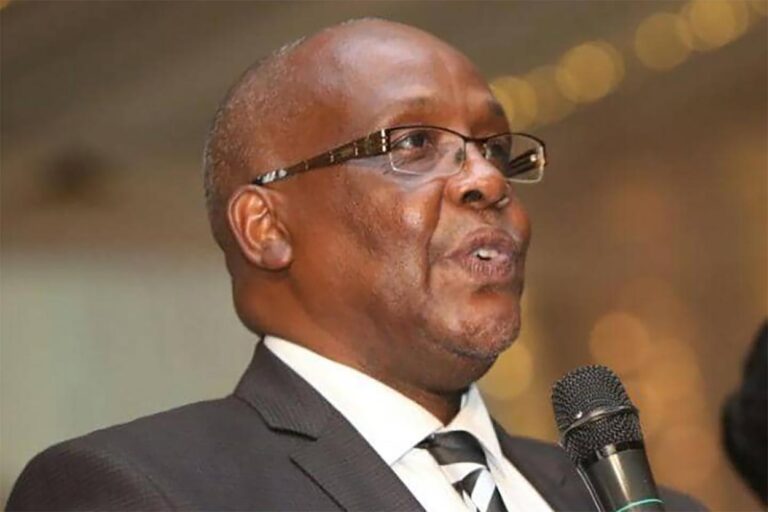

John Rujoki Musinguzi, the URA Commissioner General addressing the press conference at their headquarters in Nakawa, Kampala

HABARI DAILY I Kampala, Uganda I The Uganda revenue Authority (URA) has surpassed the revenue collection target for the first half the FY 2024/25 by sh322b giving Government some breathing air when it comes to service provision.

Speaking at a press briefing held today at the body’s headquarters in Nakawa, John Rujoki Musinguzi, the URA Commissioner General said that the net revenue collections for the Half year, that is the period July 2024 -Dec 2024 were sh15,248.99 billion against a target of UGX 14,926.85 billion.

“We registered a notable surplus of sh322 billion and a performance rate of 102.16 percent. This is way beyond our target for the period under review,” he said.

He noted that a growth in net revenue of sh2,112.25 billion (16.08 percent) was registered in July to December FY 2024/25 compared to July to December FY 2023/24.

“This performance was as a result of stable and resilient economic performance and enhanced administrative measures as well good cooperation of our patriotic tax payers,” he said.

On the domestic tax revenue collection front, from July to December 2024, URA managed to collect sh10,131.57 billion against a target of sh9,874.50 billion.

“We therefore registered a surplus of sh257.06 billion, and a performance rate of 102.60 percent. This is a growth of sh1,322.57 billion (15.01 percent) registered in July to December FY 2024/25 compared to July to December FY 2023/24,” said Musinguzi.

A cross section of URA commissioners led by Musinguzi (C), the Commissioner General

Abel Kagumire, the URA Commissioner, Executive Office Operations, said the trend where domestic taxes are contributing more than customs is a positive one.

“This in a way speaks about the future of tax collection. A few years ago, customs were contributing about 65 or 70% when the domestic taxes were contributing about 40%,” he said.

He added that Government is now concentrating more on industrialisation and import substitution, meaning the domestic tax basket is expanding.

International trade tax

When it comes to International trade tax collections, from July to December, URA collected sh 5,426.46 billion against a target of sh5,454.72 billion.

“This resulted into a performance of 99.48 percent and a significant revenue growth of sh780.06 billion (16.79 percent) was achieved. This was compared to same period last FY, that is July -Dec 2024, when the collections were sh28.26b below the target.

Musinguzi attributed URA’s good revenue collection performance to enhanced administrative measures in form of enhanced compliance initiatives, arrears management, deliberate compliance engagements with the tax payers, as well as increased Taxpayer training and sensitization.

“We also managed to use alternative dispute resolution, sector based compliance management, use of information, tax investigations, and use of technology,” he said.

Musinguzi addressing the press conference

In the first half the current financial year, there was also increased field operations and engagements. These he said included continuous taxpayer engagements, and intensified field activities. “These have driven higher remittances from taxpayers.”

There has also been an improvement in compliance processes like the filing process for rental tax and local excise duty using prefilled returns.

“The return prefilling reduces the turnaround time and the cost of compliance for the taxpayers,” said Musinguzi.

420,183 new taxpayers

URA also registered an expansion of the tax base during the first half of the FY 2024/25.

“420,183 new taxpayers were added to the tax-payer register, bringing a total of 4,881,983 taxpayers. The new taxpayers so far yielded sh59.01 billion for the period July –Dec,” he said, adding that of these, 232,063 were non-individuals and 4,649,920 were individual tax payers.

Musinguzi said the growth in the register is accredited to use of 3rd party information, process simplification for TIN acquisition and increase field operations and engagements.

“The other factor is the implementation of government policy on income tax Waiver, in line with section 47A of the income tax Act. This resulted into Revenue collection of principal tax of sh261.98 billion and waived penalties worth sh2.73 billion and Interest sh111.79 billion as at 31st December 2024.”

Sh38 billion recovered from defaulters

Musinguzi further disclosed that customs country-wide enforcement operations during the first half of FY 2024/25 led to a recovery of sh38 billion.

“As a consequence, there were 9,303 seizures of which 8,696 were for dutiable goods and 607 seizures were for non-dutiable goods,” he said.

He further reported that in the month of December, 2024, the Legal Services and Board Affairs (LSBA) department recorded a total collection of sh86.067 billion and $2800, of which ADR contributed a total of sh55.25 billion.

Rosy outlook

URA has a net revenue collection target for the second Half of FY 2024/25 is sh16,442.32 billion

“This represents a share of 52% of the annual target. The target for the FY 2024/25 will remain achievable given the robust strategy and administrative measures that are being implemented.”