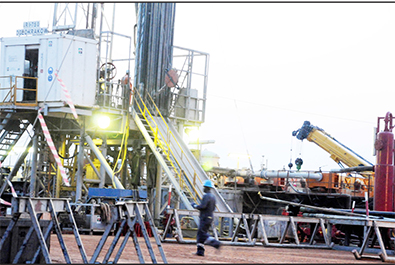

Kampala, Uganda I HABARI DAILY I Two years before it produces its First Oil, which is slated for 2025, Uganda has started minting millions of dollars from this valuable natural resource. This has come in through both oil and non-oil revenue.

According to the Uganda Extractive Industries Transparency Initiative (UGEITI) Report for Fiscal Year 2019-20, revenue generated from the extractive industries amounted to sh436 billion in Financial Year 2019-20.

“Total revenues received from the extractive sector Revenues collected by the Uganda Revenue Authority (URA) accounted for 96.97% of the total revenue streams generated by the sector,” reads part of the report.

This report covers payments made by extractive entities and revenues received by Government agencies and other material payments and benefits to Government agencies as stated by Requirement 4.1 of the 2019 EITI Standard.

“It also includes contextual information about the extractive industries in accordance with EITI Requirements 2, 3, 4, 5 and 6,” further reads the report.

Information contained in the report include a summary description of the legal framework and fiscal regime, an overview of the extractive sector, the extractive industries’ contribution to the economy, production data, the State’s shareholding in extractive entities, revenue allocations, license registers and license allocations.

The macro-economic data provided by the Uganda Bureau of Statistics (UBOS) indicates that the mining and quarrying sector accounted for sh2,266.31b in the Financial Year 2019/20.

“This represents 1.63% of the national GDP on current basic prices, including 1.17% from formal sector activity and 0.46% related to informal sector activities,” further reads the report.

It stipulates that the contribution of the mining and quarrying sector to GDP has decreased compared to the prior year’s contribution of 1.72%.

“Data from UBOS also indicates that the oil and gas sector employs 178 persons directly while ASM’s direct employment is estimated at approximately 300,000 jobs. All direct employment represent 1.84% of the country’s total workforce of 16.3 million,” revealed the UGEITI report.

It further discloses that the contribution of the extractive sector to Government’s revenue amounted to sh436.35b, accounting for 1.27% of the total domestic revenues in the Financial Year 2019/20.

“The value of exports from the extractive sector amounted to sh2.598b, accounting for 0.02% of the country’s total exports in the Financial Year 2019/20.

Both the Directorate of Petroleum and the Petroleum Authority of Uganda (PAU) have confirmed that there was no oil and gas production during the fiscal year 2019/20.

BENEFICIAL OWNERSHIP

Uganda, which discovered commercially recoverable oil reserves way back in the 1960’s, was admitted as an EITI implementing country in August 2020.

With current oil exploration work taking place in the Albertine Graben region, Uganda’s proven crude oil reserves stand at 6.5 billion barrels with 1.4 billion barrels that are commercially recoverable.

On the other hand, the country has a large artisanal and small-scale mining sector.

“Uganda aims to use EITI membership to strengthen efforts in ensuring overall transparency in the sector, strengthen tax collection, promote public debate, improve the investment climate, build trust and create lasting value from petroleum and mineral resources,” reads part of a statement from EITI.

To achieve these objectives, UGEITI developed a work plan, which includes activities such as the development of a policy and plan on contract and license publication, as well as the documentation of planned reforms on beneficial ownership transparency.

“We also undertook to conduct a scoping study on state participation in the extractive sector and activities relating to communication and dissemination of data.”

Uganda further undertook to seek to enhance revenue management and accountability. This, it pledged to do through the publication of data on social and environmental expenditures, quasi-fiscal payments and the documentation of environmental impact.

In its beneficial ownership disclosure, the report says the Income Tax (Amendment) Act 2019 defines a beneficial owner and the AML Act 2013 defines a politically exposed person.

It further says that legal ownership information of a company can be accessed from Uganda Registration Services Bureau (URSB) at a fee called ‘Search Fees’ and it is set at sh25,000.

“However, todate, there is no comprehensive register of data on beneficial owners of all companies operating in the mining, oil and gas sectors,” reads the report, adding that the production sharing agreements signed with Oil and gas companies are not currently publicly available.

“In view of the ongoing challenges associated with the COVID-19 pandemic, the EITI Board agreed the extension of measures to provide Uganda the flexibility in EITI implementation and reporting,” reads the report.

It points out that these measures allow implementing countries to retain the momentum of the EITI process while adapting to local circumstances and urgent information needs.

“MSGs may prepare EITI reports based on information disclosed by government agencies and/or companies, subject to MSG endorsement, and provided that the flexible reporting requirements are met.”

MSGs are encouraged to use this flexibility to communicate timely data that is relevant to the situation in their country. For example, they can consider including current or forward-looking information on production, exports and revenues, or disclosing licenses or contracts recently awarded which might affect future extractive revenues.

The UGEITI Multi-Stakeholder Group (MSG), which comprises of government representatives, extractive company officials and civil society organisations working together, therefore decided to adopt flexible EITI reporting for its first EITI report.

“We henceforth decided to prepare the first UGEITI report covering Financial Year 2019/20, by adopting the flexible EITI reporting and to include in the reconciliation scope only the four oil and gas companies present in the country, and which held active licenses during the fiscal year 2019/20,” further reads the report.

It says in the reconciliation scope without considering any materiality threshold, the Petroleum Authority Uganda (PAU) provided the list of active oil and gas companies which held licenses during the fiscal year 201920.

Total reconciled revenues from the four (4) oil and gas companies included in the reconciliation scope amounted to sh42,244m. The UGEITI MSG agreed to include the two main Government agencies that collected revenues from the extractive entities. These included the Uganda Revenue Authority (URA) and the National Environmental Management Authority (NEMA) in the reconciliation scope.

MINING SECTOR

For the unilateral disclosure for the mining sector, as agreed by UGEITI MSG, revenues collected from mining entities were included in the EITI Scope through unilateral disclosure by Government Agencies in accordance with EITI Requirement 4.1.d.

“Based on the above, we included payments of sh374,939m as unilateral disclosure by Government Agencies in the report. These unilateral disclosures represent 100% of the revenues of the mining sector,” says UGEITI.

It further says that all Government agencies submitted their reporting templates.

“All oil and gas companies included in the reconciliation scope submitted their reporting templates. Based on the above, we conclude that all significant contributions made by extractive entities to the revenues have been comprehensively covered in the UGEITI report.”

DATA QUALITY

According to UGEITI, all Government agencies submitted their reporting templates signed by a senior official as agreed by the UGEITI MSG.

It however says the Government audited accounts as presented in the Office of the Auditor General (OAG) annual report could not be reconciled with the receipts reported by URA and NEMA in their reporting templates, given that the figures of the annual report were aggregated.

According to John Muwanga, the Auditor General, Ugandan districts lack of data regarding the volume and value of minerals mined, making the country lose billions of dollars annually in revenue.

“In the absence of this information, management cannot ascertain the amount of royalties due to the districts, which affect planning and budgeting processes. The affected districts are therefore unable to interrogate any under-remittance of royalties, which in turn negatively affects service delivery,” reads part of the annual report of the Auditor General to Parliament for the financial year ended 30th June 2022.

Several districts additionally lacked records regarding the volume and value of minerals mined by the various mining parties, which include companies, individuals and associations.

Signed by Muwanga, the report recommended that districts should sign Memorandum of Understanding (MoU) with mining firms and the ministry of Energy and Mineral Development (MEMD).

The UGEITI report further says receipts reported by URA and NEMA amounted to sh42,244m representing 100% of the total reconciled revenues. All four oil and gas companies submitted reporting templates signed by an authorised officer at management level.

“One company namely Oranto Petroleum Ltd submitted reporting templates that were certified by an external auditor and its audited financial statements. Three oil and gas companies submitted reporting templates that were not certified by an external auditor. They also did not submit their audited financial statements” further reads the report.

It further says the revenues reported (by Government Agencies) in respect of the latter three companies amounted to sh40,525m, representing 96% of the total reconciled revenues.

“The purpose of reconciling payment flows was to identify any potential discrepancies in the declarations and to clarify them. The discrepancies initially identified were analysed and adjusted whenever the relevant supporting documents were made available by the reporting parties,” further reads the report.

It says based on the data collected from extractive entities and Government agencies, revenues generated from the extractive industries amounted to sh 436,353m.

The revenues included in the reconciliation scope amounted to sh42,244m and represent 10% of the total extractive revenues during the fiscal year 2019-20.

“The remaining 90% of the extractive revenues amounting to sh394,109m are subject to unilateral disclosure in accordance with the provisions for flexible reporting set out in Section 2.6.”

It says following the adjustments resulting from the reconciliation exercise, a net difference of sh4m remained unreconciled and which represents (0.01%) of Government revenues of sh42,244m included in the reconciliation scope.

SYSTEMATIC DISCLOSURE

UGEITI made Relevant recommendations and additional measures to be implemented in order to improve the EITI process in Uganda. These include mainstreaming and systematic disclosure of EITI data. In this, the EITI data disclosed in this report was collected from different sources, including Government agencies selected in the UGEITI reporting process.

“However, regarding the contextual information on the extractive sector, data on revenues collected and budget allocations are not systematically published within a centralised platform.”

It further recommended that Government agencies should set up an open EITI database in their systems, ensure public disclosure of the register of licenses, including the full text are available from DGSM at a fee.

“It is recommended to make publicly accessible the full text of the licenses, as detailed in Section 8.2. The production sharing agreements signed with oil and gas companies are not currently publicly available, as they should be.”

It further says the UGEITI MSG should set out a clear roadmap for the publication of all agreements in the extractive sector, and pointed out that a number of reporting entities did not comply with the assurance process agreed upon by the UGEITI MSG.

“The UGEITI MSG should engage with reporting entities and emphasize the importance of complying with this provision of proper signature and certification of templates by auditors for future reports, in order to meet EITI Requirement 4.9,” the report points out.

It says the two agencies concerned, which include the DGSM and URA, do not systematically cross-check export data against each other’s records to identify the inconsistencies.

“DGSM and URA should implement automated controls to ensure the comprehensiveness of export data reported by extractive entities, and develop analytic tools to ensure better control of mineral trading.

The report says that to date, there is no comprehensive register of data on beneficial owners of all companies operating in the mining, oil and gas sectors.

The body recommended that the UGEITI MSG and URSB put in place a roadmap relating to the disclosure of information on beneficial ownership.